Key Facts

- Elizabeth Holmes first forwarded the idea of Theranos while studying Chemical Engineering at Stanford University.

- Theranos was backed by powerful investors with Henry Kissinger, William Perry, and George Shultz on its board.

- Following an investigation by Wall Street Journal investigative journalist John Carreyrou, Elizabeth Holmes was found to have falsified the nature of the services Theranos was able to provide.

On January 3rd, 2022, Elizabeth Holmes was found guilty on 4 counts out of the 11 she was accused of. The jury determined that she had defrauded her investors in biotech company Theranos. Her sentencing is slated to take place on September 26th. So, what’s the main Theranos failed?

If someone told you that would be the fate of Elizabeth Holmes and the company she founded in 2013, it would have seemed farfetched. In 2013, Theranos was riding high as one of the most exciting companies in Silicon Valley. They had just struck a strategic partnership with Walgreens to open “Wellness Centers” nationwide.

Theranos was valued at just over $9 billion and was backed by the who’s who of powerful tech investors. Henry Kissinger and George Shultz and other heavy hitters were part of its board. And Elizabeth was on the way to becoming one of the world’s richest women.

Then it all fell apart. The rug was pulled out from under the feet of all those powerful people, and Theranos was exposed as a massive fraud unlike any in recent memory. Theranos and Elizabeth Holmes went from Silicon Valley darlings to pariahs. It didn’t all happen instantaneously, but once the wheels started coming off, nothing could stop them.

So, what happened? How did this company implode so spectacularly? And who is ultimately responsible? Elizabeth Holmes is certainly guilty, and so is her partner in crime, Ramesh “Sunny” Balwani. But who else deserves the blame? Is this just the story of a grifter who rose to superstardom? Or does it reveal a fundamental sickness at the heart of Silicon Valley and those of us who idolize it?

Who is Elizabeth Holmes?

Enter Elizabeth Holmes, the main culprit in Theranos failure. She was born to Christian Rasmus Holmes IV and Noel Anne Daoust in 1984. Her father was an executive VP at Enron, another scandalous company. He was not indicted when the company’s wrongdoing was exposed. Her mother worked as a Congressional staffer in Washington, DC.

Christian Holmes is a descendant of Charles Louis Fleischmann, the founder of the Fleischmann Yeast Company. Fleishmann’s family was among the wealthiest country at the time. But as the wealth and influence of the company waned, so too did the family status.

Reports suggest Christian Holmes deeply lamented the loss of the family’s status and wealth. Even though his family was far from being destitute, he remained unsatisfied. This is a trait that Elizabeth Holmes would adopt.

Elizabeth grew up idolizing Silicon Valley legends like Steve Jobs. When asked what she wanted to do when she grew up, she answered: “I want to be a billionaire.” From the start, Elizabeth Holmes dreamt of becoming a wealthy and powerful entrepreneur like the people she idolized.

Stanford and The First Patent

With dreams of Silicon Valley stardom, Elizabeth Holmes enrolled at Stanford in the chemical engineering program. In her freshman year, after some time working in a laboratory in Singapore, she filed for her first patent. The patent was for a drug-delivery patch.

Around the same time, she became obsessed with the idea of using a small sample of blood to run a wide variety of medical tests. The idea purportedly came from her fear of needles and getting her blood drawn.

She approached many of her professors with the idea, including professor of medicine Phyllis Gardner, who would become one of her biggest early critics. Gardner told Holmes flat out that the idea didn’t hold any water, and she wasn’t alone. She was backed up by nearly all her Stanford colleagues except Channing Robertson, who sided with Elizabeth Holmes.

He would eventually leave with Elizabeth when she founded the company that would become Theranos.

The Rise of Theranos

©Kevin Krejci / CC BY 2.0, Flickr – Original / License

Theranos came from a portmanteau of the words “therapy” and “diagnosis.” Some critics have drawn the similarity of Theranos to the Greek god of death, Thanatos, as a prophetic coincidence.

Elizabeth’s theory was simple, traditional blood drawing procedures are uncomfortable and frightening to some. Taking large amounts of blood is the only way to accurately test for all sorts of things, but what if there was another way? Elizabeth claimed she could figure out a way to do all those tests without intrusive needles or large amounts of blood. Instead, she devised the nanotainer, a small vial that would extract a single drop of blood.

This small drop would be used in all tests previously done by large-scale machines. The only problem she encountered was that the technology didn’t just only not exist, it was impossible. Like her professor Phyllis Gardner had said, it just doesn’t work like that.

Still, Theranos raised nearly $1.3 billion over its lifetime and remained a private company, likely due to the “fake it or make it” nature of their work. So, how did this happen? How did Stanford drop out with an impossible idea, dupe everybody she spoke to and endanger the lives of hundreds if not thousands of people?

The Myth of Elizabeth Holmes

Any marketing or advertising specialist will tell you that storytelling is the most powerful tool for businesses. Elizabeth Holmes used it effectively to sell the company and the idea to investors.

Personal Stories

Elizabeth Holmes liked to tell personal stories to relate to her audience. She was good at telling these tales in a way that made you empathize with her and root for her to succeed. She claims she spent most summers with a beloved uncle. This uncle would later die of cancer because they didn’t catch it in time.

Another piece of the story she crafted was her fear of needles and how it pushed her to find a way to make phlebotomy easier. She even named her blood analysis machine Edison after another child hero, Thomas Edison. She was fond of quoting Edison’s saying: “I have not failed. I’ve just found 10,000 ways that won’t work.”

“Fake It Til You Make It”

This is nothing new in Silicon Valley, right? We’ve all heard the phrase “fake it til you make it.” Move fast and break things was the famous motto of Facebook’s Mark Zuckerberg. While there are major problems with this kind of culture, it was specifically pronounced in Theranos’ case.

Theranos wasn’t producing a smartphone or social media app, they were producing medical equipment for everyday use. Blood tests are one of the simplest and quickest ways to discover disease and begin treatment. Accuracy is key, and people’s lives depend on it.

This is a harmful mentality, as we’ve seen from the many Facebook scandals. But it’s especially bad when you lie to patients just to keep your partners and investors happy. It’s one of Phyllis Gardner’s critiques of Elizabeth and her idea at Stanford. But Elizabeth didn’t get the message until it was too late.

The All-Star Board and Investors

Theranos had grown tremendously when the other shoe dropped, and it had a board filled with powerful people. People like Henry Kissinger, George Shultz, William Perry, Jim Mattis, and Richard Kovacevich joined the board and remained active until Theranos was dissolved.

Holmes also enjoyed much support from celebrity investors like Larry Ellison, Rupert Murdoch, and Don Lucas. Lucas, in particular, became a champion for Elizabeth Holmes and her company.

Theranos had partnerships with some of the most powerful Silicon Valley figures and even had a board filled with former US Presidential Secretaries. The thing Theranos didn’t have actual doctors, scientists, and medical researchers in the leadership. At one point, Theranos hired away Avie Tevanian, who had been Steve Jobs’ top software engineer.

Tevanian is undoubtedly a smart guy, but what purpose would he serve at a medical tech company? Holmes always presented the image that her company was a futuristic powerhouse with all these power players, but no one in the room understood the science.

The Wall Street Journal Article

Wall Street Journal reporter John Carreyrou, in his investigations, discovered that Theranos’ Edison machine fell short of the capabilities the company had claimed. Elizabeth Holmes had built a brand image that sold Edison as a new way to do blood testing. She claimed that the machine was already operable and would routinely demonstrate the machine during investor walk-throughs.

She also claimed that Theranos had multiple military contracts that put Edison machines in field helicopters. The WSJ reporting revealed that none of that was true and that something far more nefarious was happening.

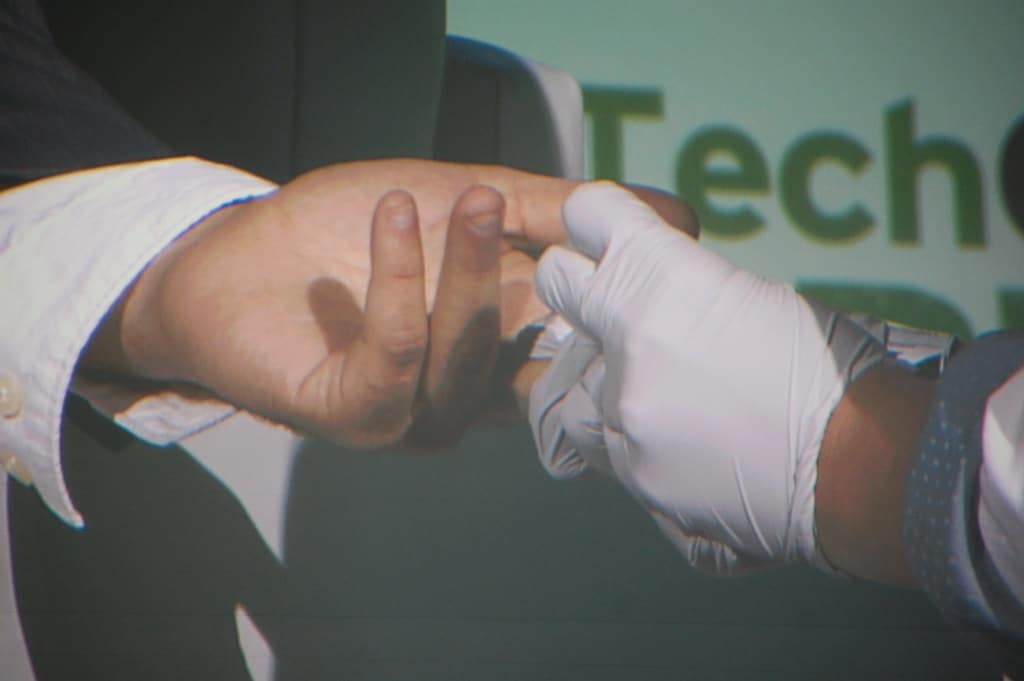

All along, Theranos pretended to use the Edison device for blood sampling. But in truth, they used commercial machines like Siemens to do the tests. When investors visited the Palo Alto campus, they would have their fingers pricked and continue the tour. The lab aides would then hastily take the blood sample, run it on the working Siemens machine and produce the results by the end of the tour.

If it had stopped there, it would just be a fraud, but it went further. Walgreens opened up 40 Theranos wellness centers in their Arizona stores and one in Palo Alto. This pilot program tested hundreds of patients and gave many false readings.

Customers would come to the wellness center expecting to give a drop of blood and get on-site results as advertised. Instead, they were given a traditional blood draw, and the samples were sent back to Palo Alto for testing.

The reporting by WSJ completely blew the smoke screen that Elizabeth Holmes and Theranos had made to investors, partners, and customers.

The Dissolution of Theranos

In the wake of the WSJ reporting, there were a lot of questions about the claims made by Elizabeth Holmes. The FDA approval of the Edison device came under scrutiny. It emerged that FDA had never approved the device for commercial use in the first place. The agency labeled the Nanotainer a Class II medical device, which meant there were restrictions on the technology.

Theranos partners like Walgreens started pushing for more answers about the products, culminating in the end of their partnership. Over the next three years, Elizabeth, Sunny Balwani, and Theranos were the subject of several lawsuits. Theranos Clinical Certifications were revoked by the Centers for Medicare and Medicaid Services.

Elizabeth tried to salvage the situation by claiming she didn’t know the extent of the problem. She claimed that lab directors fed her wrong information and that she would do a thorough review of Theranos’ clinical practices. But the façade had been shattered, and there was no coming back.

Theranos was dissolved in 2018.

Why did Theranos Ultimately Fail?

Theranos was doomed to fail from the start. At Stanford, Elisabeth Holmes had repeatedly been told that the science didn’t add up. She ignored that advice from everyone, and it led to her company’s catastrophic failure.

There is nothing wrong with having a vision and a dream. Elizabeth Holmes truly believed in what she was doing despite her detractors, and that’s the problem. We’re all fed the belief in the mythical inventor, the Steve Jobs, Mark Zuckerberg, and Thomas Edison of the world. But that is all just marketing and fluff.

Sure, some of those creators are important, but they aren’t all-knowing, and their success isn’t a foregone conclusion. The creation of the iPhone isn’t just the work of one man but dozens of people. Elizabeth was chasing a myth.

But the blame shouldn’t fall squarely on her shoulders. Her vision might have been tainted, but she was egged on by those around her. Early investor Don Lucas said in an interview that he was impressed that she “came by these two things (medicine and entrepreneurship), quite naturally.” This was in reference to her father and Uncle, who were entrepreneurs and doctors.

These were the criteria that he used to back her. Not financial reports, not a demonstration of a working device, not even a timeline of when the machine would be ready. He liked her story and her background, and that was it.

Most investors she worked with didn’t see financial or medical reports. They didn’t do the due diligence. It’s because they all hoped they had found the next Steve Jobs, the next big thing, and everyone wanted a piece. And while they all toasted the company’s success, the actual science, the ones working on the product, and the customers it harmed were an afterthought.

Next Up

Did you enjoy this story? If so, check out some of the other companies that failed spectacularly below.

- The Real Reason Atari Failed Spectacularly: Founded in 1972, with a minute sum of cash, Atari soon became worth billions. However, adverse events in the sector would lead to its decline. This is the story of the outfit considered to be the first true pioneer in the gaming industry.

- The 5 Real Reasons Polaroid Failed: It reached its peak in the 1990s only to file for bankruptcy by the turn of the century. Find out how it all came to be.

- The 5 Real Reasons Netscape Failed: It once ruled the internet and by 1996 claimed 90% of the web browser market. By 2002, that figure had plummeted. This is the tale of Netscape.